27.5% VAT On Textbooks Causes Uproar In Education Sector

The Ghana Publishing Association (GPA) has criticized the government’s decision to impose a 27.5% Value Added Tax (VAT) on imported textbooks, warning of severe impacts on the education sector. GPA President, Asare Konadu Yamoah, stated that this move seems to be a deliberate attempt to undermine an industry already facing significant challenges.

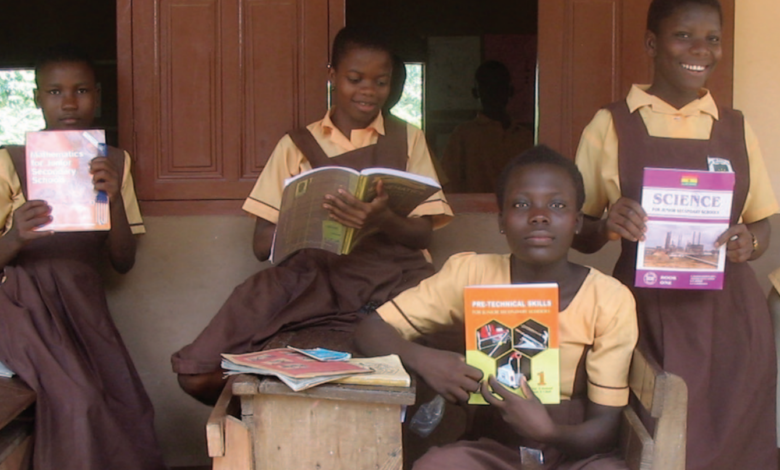

Yamoah highlighted that with the local printing industry only able to meet 40% of the demand, the increased VAT will make importing essential textbooks unaffordable for publishers. This situation is most likely to create a shortage of necessary educational materials.

As a result, both students and educators will face difficulties in accessing crucial resources, which could hamper the quality of education. The GPA is urging the government to reconsider this tax policy to avoid further damage to the already struggling education sector.

He told AdomNews:

“This decision will have a ripple effect on the entire education sector,”

“We urge the government to reconsider this punitive tax and find alternative solutions to support the growth of the publishing industry.”

The GPA’s caution serves as a sobering reminder of how crucial easily available and reasonably priced educational resources are to forming Ghana’s youth’s future.

Will the government do something to lessen the harm after issuing this warning, or will the education industry be forced to absorb the majority of this contentious tax increase?

Credit: AdomNews

Read Also: Gyampo: Free SHS Structure Doesn’t Support Quality Education