The Ghana Statistical Service has released data that shows a notable decline in cocoa bean export values for the second quarter (Q1) of 2024.

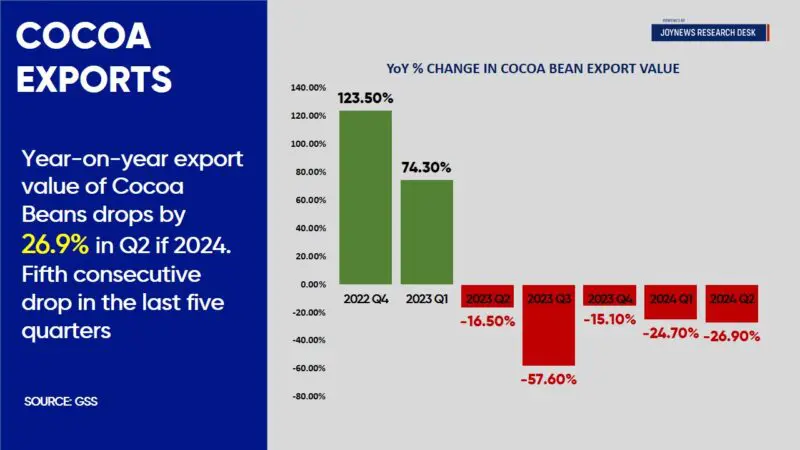

In the second quarter (Q2) of 2024, the export value decreased by 26%, from GH₵ 1.57 billion in Q2 of 2023 to GH₵ 1.15 billion in Q2 of 2024.

The drop in cocoa bean shipments for the seventh consecutive quarter is part of a larger trend.

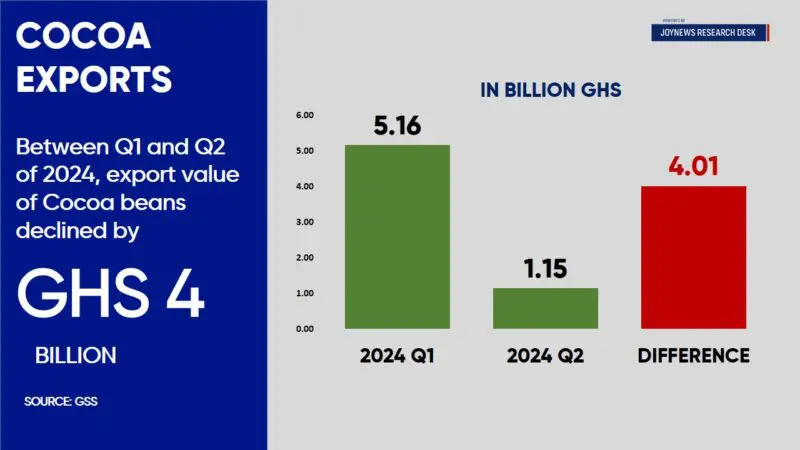

Comparing Q1 of 2024 to Q1 of 2023, there was a 24.7% decline in the export value. Interestingly, there was an even more significant quarterly loss between Q1 and Q2 2024—an 80% drop that translates to a reduction of GH₵ 4 billion.

Supply and Price Dynamics

The lower export values coincide with a difficult manufacturing season. Ghana produced 429,323 metric tons of cocoa by the end of June 2024, which was less than 55% of the average production in prior years. It is anticipated that this deficit will lead to the lowest yearly output in more than 20 years.

A four-year supply shortage in the world market for cocoa has driven up prices due to poor harvests in Ghana and Ivory Coast. Due to extensive smuggling operations, Ghana has not profited from the rise in world prices.

Over a third of Ghana’s projected 2023–24 cocoa production—roughly 160,000 metric tons—has been lost as a result of farmers selling to trafficking gangs due to low local prices and payment delays.

Price Adjustments and Smuggling

The farm gate price for the 2024–2025 season has increased by 45% due to Cocobod’s response to the problem, from GH₵ 2,070 to GH₵ 3,000 per 64-kilogram bag. Smuggling was previously encouraged by Ghana’s pricing being GH₵ 490 less than those of Côte d’Ivoire.

The impact of Ghana’s price change is undetermined because Côte d’Ivoire has not yet announced its 2024–2025 price, despite the fact that the new price is currently GH₵ 440 higher than the existing cost.

Ghana’s cocoa export value has declined, which is indicative of larger problems with smuggling, market dynamics, and production shortages. The farm gate price rise is a step in the right direction, but how effective it is will rely on local pricing tactics.

Read Also: Cocoa Farmers To Enjoy Nearly 45% Price Increment This Year