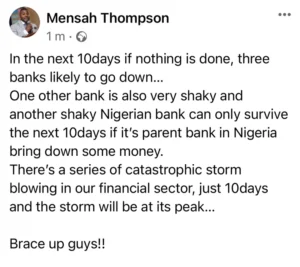

Mensah Thompson, Executive Director of the Alliance for Social Equity and Public Accountability (ASEPA), has disclosed that in the next ten days, three banks will collapse.

According to the ASEPA boss, one other bank is shaky and a Nigerian bank in Ghana can only survive if its parent bank in Nigeria sends some money to sustain it.

Read Also:

10 Suspected National Security Operatives Remanded

Mensah Thompson in a Facebook post said there’s a series of catastrophic storms in the financial sector of the country, adding that the storm of bank collapse will be at its peak in 10 days. He urged Ghanaians to brace up for more calamities in the banking sector.

ASEPA is warning Ghanaians to desist from working with individual banks. The said banks are collapsing due to government mismanagement of the country’s economy.

The Minority leader in Parliament, Dr Cassiel Ato Forson, warned that 17 banks in the country are at risk as a result of the government’s domestic debt exchange programme.

According to Mr Forson, the programme will rather shift the bankruptcy of the government to individuals and financial institutions, particularly banks.

Read Also:

Christian Atsu Should Have Given His Money To The Church Instead Of Poor People – Pastor

Ato Forson debating the programme on the floor of Parliament said it will impoverish Ghanaians and cripple some banks.17 banks in the country are at risk as a result of the domestic debt exchange programme. What ASEPA is alleging is that the banks do not have the financial willpower to sustain themselves.

To preserve the stability of the global financial system and support the global economy, the Bank of Ghana has been the first line of defence. First, they have significantly increased monetary policy rates.

In 2018, a financial sector cleanup undertaken by the Bank of Ghana resulted in the revocation of the licenses of many financial institutions including banks and microfinance companies.

Banks that collapsed and officially ceased to be in existence after the financial Sector including Capital Bank and UT Bank were taken over by GCB Bank in a purchase and assumption agreement. ASEPA is advocating for the government to cut down its elephant size.

Read Also:

Bolga High Court Revoke Arrest Warrant Against Nayiri

However, seven banks namely: The Royal Bank, Heritage Bank, Construction Bank, Unibank Sovereign Bank, The Beige Bank, and Premium Bank had their licenses revoked and placed under the Consolidated Bank of Ghana.

Six Banks merged (3 mergers): First Atlantic Merchant Bank Limited and Energy Commercial Bank, OmniBank Ghana Limited and Bank Sahel Sahara Ghana, and First National Bank and GHL Bank Limited reached merger agreements.

Before you go, kindly Follow Us for more exclusive news updates on all social media platforms. Also, join our growing online family and be part of Us.