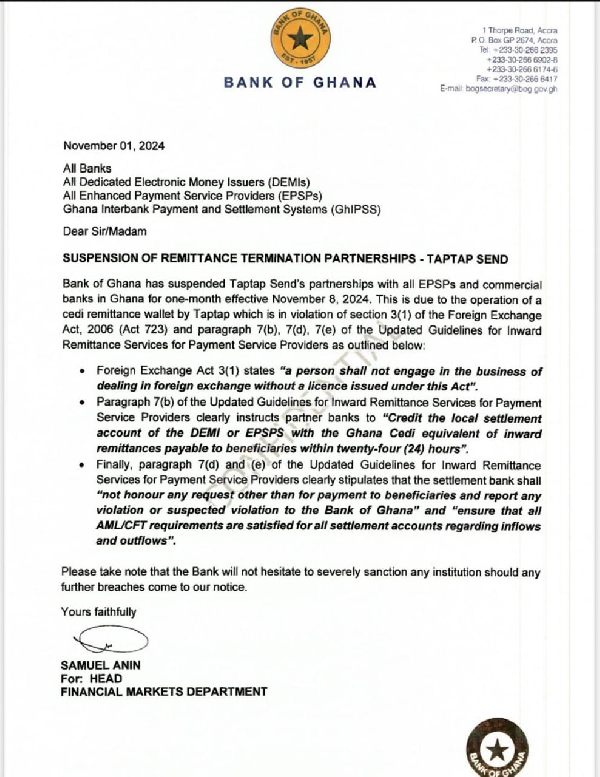

Taptap Send’s remittance services with commercial banks, Dedicated Electronic Money Issuers (DEMIs), and Enhanced Payment Service Providers (EPSPs) in the nation have been suspended for a period of one month by the Bank of Ghana (BoG).

In response to regulatory infractions concerning a cedi remittance wallet run by Taptap Send, the suspension will go into effect on November 8, 2024.

According to a statement from the BoG, the violation is covered by Section 3(1) of the Ghanaian Foreign Exchange Act, 2006 (Act 723), which mandates that companies that deal in foreign exchange must get the appropriate license.

Additionally, Taptap Send is charged with breaking certain clauses in the Updated Guidelines for Inward Remittance Services, which establish anti-money laundering (AML) and counter-financing of terrorism guidelines and set requirements for the crediting of local settlement accounts.

In these instructions, the Bank of Ghana emphasized a number of crucial requirements. These include strict AML/CFT compliance by settlement banks and a 24-hour timeframe for remittance payments to reach beneficiaries. Additionally, banks are required to notify the BoG of any suspected regulatory infractions.

The BoG’s Financial Markets Department issued a warning, stating that any additional violations could lead to harsh sanctions for institutions that do not comply.