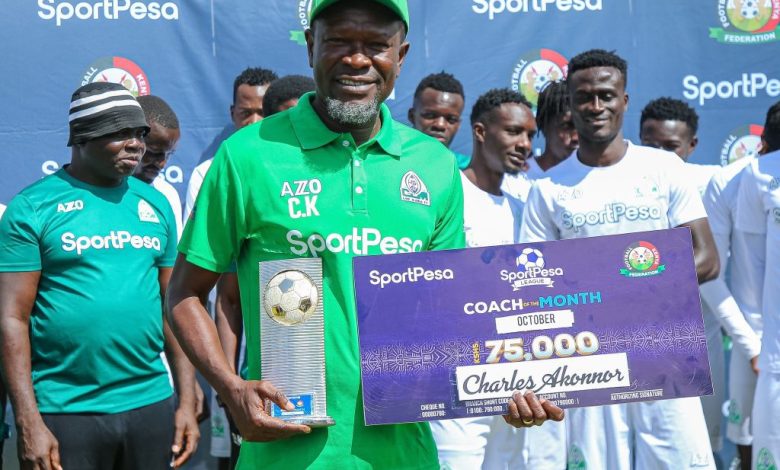

Gor Mahia trainer CK Akonnor has been named Coach of the Month (October) in the Kenyan Premier League.

The former Black Stars coach recorded a 100-percentage win; kept three clean sheets and conceded zero goals.

Akonnor pocketed Sh75,000 (GH₵ 6,387.60) for winning SportPesa League’s Coach of the Month award.

On Saturday, 22 November 2025, Gor Mahia beat Tusker 1 – 0 at home extending their lead at the top of the SportPesa League table.